The closer Brexit gets, the worse the pound performs

- RCS Ottawa

- Oct 4, 2016

- 1 min read

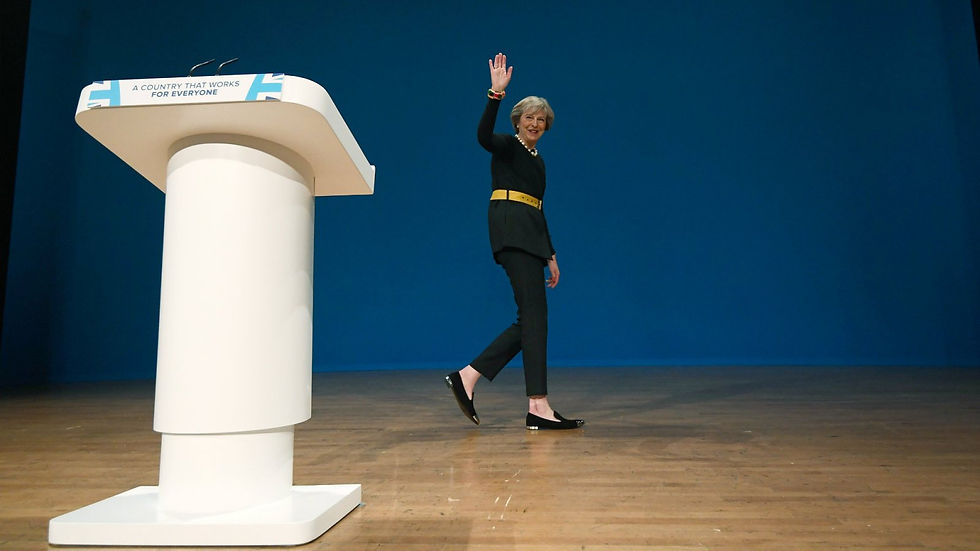

British prime minister Theresa May said Oct. 2 that she would officially start the process for Britain’s exit from the European Union no later than March 2017. When traders got to work on Monday morning, they promptly sold the pound, pushing the currency down to fresh post-referendum lows versus the dollar.

Since the vote to leave the EU on June 23, the pound has lost around 14% of its value versus the dollar, and hasn’t performed much better against the euro. Until yesterday, the most clarity May provided about EU exit negotiations was to stress that “Brexit means Brexit.” Now that she has revealed a timetable for triggering Article 50, the part of the EU treaty that sets a two-year deadline for members to negotiate their departure from the EU, markets have better information.

Investors have concluded that this is a bad thing for sterling. Full Story

Comments